Candle Scores

$49

Enhance your trading strategy with this powerful script that analyzes candlestick patterns, utilizing a normalized distribution approach to identify significant buying and selling signals based on volume deviation.

Details

- Signal Threshold Control: Set your desired signal threshold for volume deviation with the user-friendly input parameter sigThreshold to customize the sensitivity of the signals according to your trading preferences.

- Normalized Distribution Calculation: The script includes a sophisticated NormDistribution function, allowing you to calculate the normalized distribution of price values within a specified length, providing a nuanced perspective on market movements.

- Candlestick Analysis: By dynamically determining whether a candle is bearish or bullish, the script captures key dimensions of the candle, including body width, top wick width, bottom wick width, and the total candle size.

- Volume Deviation Signals: Utilizing the normalized distribution, the script computes buying and selling components based on the candlestick dimensions and average volume. The resulting deviation values are used to trigger insightful chart bubbles, highlighting potential buying opportunities in green and selling signals in red, adding a visual layer to your technical analysis.

Automatic VWAP

$79

This script dynamically plots lines associated with the latest significant VWAP thresholds, utilizing parameters like specific arrow thresholds to analyze candlestick patterns through a normalized distribution, providing automatic identification of key buying and selling signals with visual representations on charts, including color-coded bubbles.

Details

- Aggregation Period Selection: The script allows users to choose from various aggregation periods such as THIRTY_MIN, FIFTEEN_MIN, ONE_HOUR, FIVE_MIN, ONE_DAY, ONE_WEEK, FOUR_DAYS, providing flexibility in analyzing different timeframes.

- Normalized Distribution Calculation: Incorporated within the script, the NormDistribution function calculates the normalized distribution of price values over a specified length, offering a nuanced perspective on market movements and aiding in identifying potential deviations.

- Automatic VWAP Calculation: The AutoVwap script dynamically computes the Anchored VWAP (Volume Weighted Average Price) based on user-defined parameters, adding a significant layer to the technical analysis by visualizing price trends and potential reversal points.

- Candlestick Analysis: Through the CandleScores script, the tool dynamically determines whether a candle is bearish or bullish, capturing essential dimensions such as body width, top wick width, bottom wick width, and total candle size for a comprehensive candlestick analysis.

- Volume Deviation Signals: Leveraging the normalized distribution, the CandleScores script calculates buying and selling components based on candlestick dimensions and average volume. The resulting deviation values trigger insightful chart bubbles, providing visual cues for potential buying opportunities (green) and selling signals (red).

Automatic Recent Fibonacci Levels

$49

This script utilizes Fibonacci retracement levels to identify potential pivot points in price movements, automatically plotting key levels and signaling pivot events, with optional alerting for significant price crossings.

Details

- Pivot Analysis: This script employs Fibonacci retracement levels to identify potential pivot points in price movements, providing a comprehensive analysis of pivot events. Users can customize the script by adjusting parameters such as lookForwardBars and lookBackwardBars to control the analysis window.

- Automatic Plotting: The script automatically plots arrows indicating significant pivot highs and lows, offering a visual representation of potential trend reversals or continuation points. Users can easily interpret these plotted points to inform their trading decisions.

- Fibonacci Ratios: Traders can customize the Fibonacci ratios used in the analysis, including firstRatio, secondRatio, thirdRatio, fourthRatio, fifthRatio, sixthRatio, seventhRatio, and eighthRatio, allowing for a personalized approach to Fibonacci-based technical analysis.

- Alert System: The script includes an alert system that notifies users when the closing price crosses predefined Fibonacci retracement levels (secondRatio, thirdRatio, fourthRatio). This feature enhances the tool's usability by providing real-time notifications of significant price movements.

- Validation Mechanism: The script includes a validation mechanism that assesses the integrity of identified pivot points, distinguishing between valid and invalid pivot events. This adds an extra layer of precision to the analysis, helping traders make more informed decisions.

- User-Friendly Inputs: The script offers user-friendly input parameters, allowing traders to easily adjust settings such as lookForwardBars, lookBackwardBars, and Fibonacci ratios. This flexibility ensures that the tool can be tailored to individual trading preferences and strategies.

Automatic VWAP based on Last Significant Scores

$49

This script calculates and plots significant Anchored VWAP (Volume Weighted Average Price) thresholds based on normalized distribution and candlestick analysis, automatically alerting users to potential trend reversal or continuation points when the closing price crosses predefined levels, with customizable parameters for enhanced trading precision.

Details

- Normalized Distribution: The script utilizes the NormDistribution function to calculate the normalized distribution of closing prices, providing insights into price variations over a specified length and aiding in identifying potential deviations.

- Automatic VWAP Calculation: With the AutoVwap script, the tool dynamically computes the Anchored VWAP (Volume Weighted Average Price) based on user-defined parameters like arrowThreshold and avwapThreshold, enhancing technical analysis with visual representations of price trends and potential reversal points.

- Candlestick Analysis: Through the CandleScores script, the tool dynamically analyzes candlestick dimensions, including body width, top wick width, bottom wick width, and total candle size. This comprehensive candlestick analysis contributes to the identification of potential trend reversals or continuations.

- Volume Deviation Signals: Leveraging the normalized distribution, the script calculates buying and selling components based on candlestick dimensions and average volume. The resulting deviation values trigger insightful chart bubbles, offering visual cues for potential buying opportunities (green) and selling signals (red).

- Alert System: The script incorporates an alert system that notifies users when the closing price crosses predefined levels, such as VWAP High ATR and VWAP Low ATR, providing real-time notifications of significant price movements for timely decision-making.

- User-Defined Parameters: Traders can easily customize the script using user-friendly input parameters like arrowThreshold and avwapThreshold, allowing flexibility to tailor the tool to individual trading preferences and strategies.

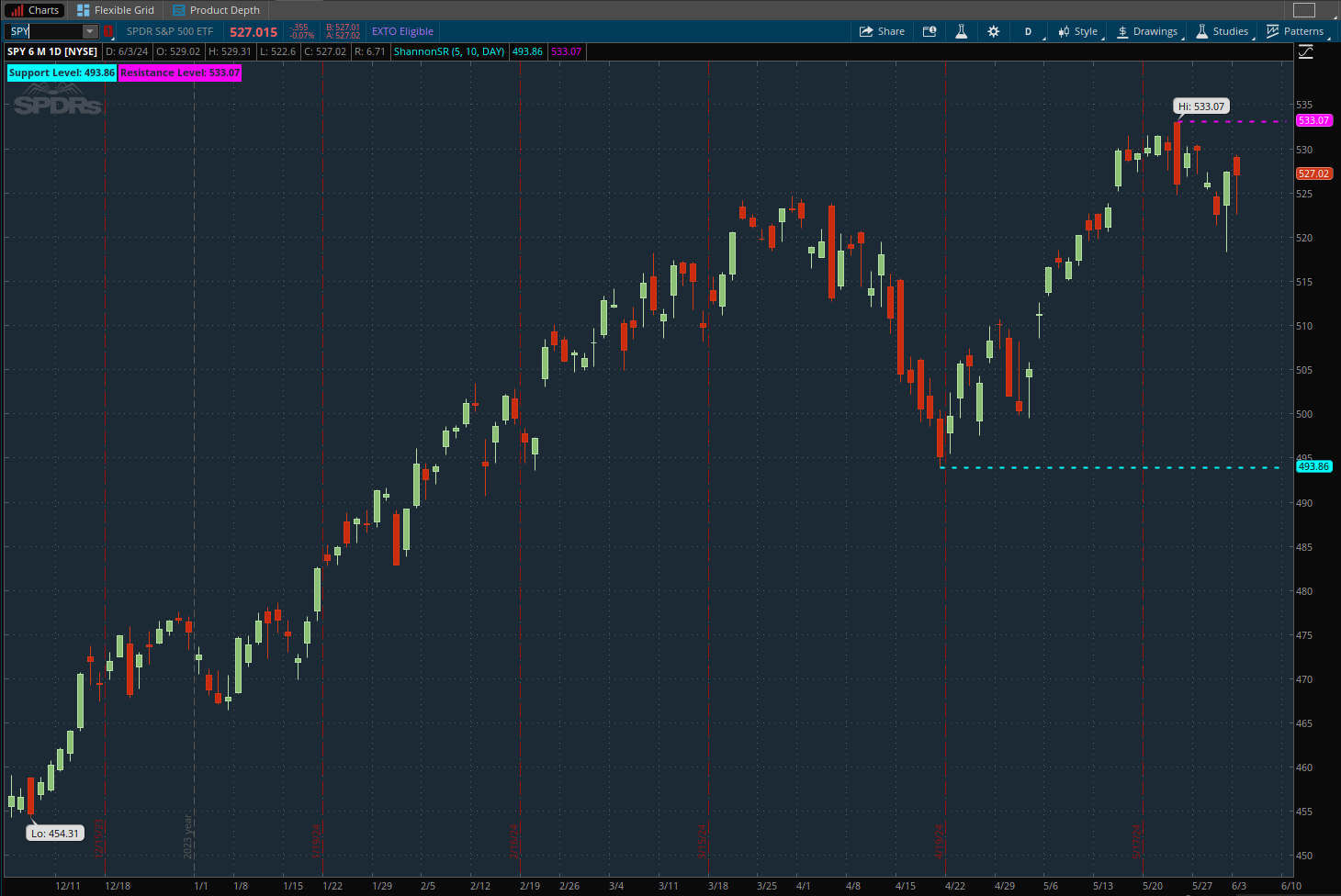

Dynamic Support and Resistance

$49

This script identifies and displays the most recent support and resistance levels based on specified lookback and lookforward periods, enhancing technical analysis for traders by visually representing key price levels on different timeframes.

Details

- Customizable Time Periods: The script allows users to select from a range of time periods, including various minute intervals, hourly intervals, and daily periods, to suit their trading strategy.

- Swing Low Identification: By defining conditions for a swing low, the script identifies and marks the most recent support level based on the lowest price within the specified lookback and lookforward periods.

- Swing High Identification: Similar to the support level, the script defines conditions for a swing high, identifying and marking the most recent resistance level based on the highest price within the specified lookback and lookforward periods.

- Dynamic Labeling: The script dynamically adds labels on the chart to display the calculated support and resistance levels, providing traders with clear and immediate visual cues.

- Plotting Support Levels: The identified support levels are plotted on the chart using a cyan color with a short dash style, making them easily distinguishable.

- Plotting Resistance Levels: The identified resistance levels are plotted on the chart using a magenta color with a short dash style, ensuring they stand out for easy reference.

- User-Friendly Inputs: Traders can customize the lookback and lookforward periods through user-friendly input parameters, allowing flexibility to adapt the script to different market conditions and trading styles.

- Automatic Calculation: The script automatically calculates and updates the support and resistance levels as new data comes in, ensuring that traders have the most current information available for decision-making.

Frequently Asked Questions

Find answers to common questions about our financial scripts, compatibility with ThinkOrSwim, and support options.

What is ThinkOrSwim?

ThinkOrSwim is a powerful trading platform developed by TD Ameritrade that provides advanced tools and features for traders.

Are the scripts compatible?

Yes, our financial scripts are specifically designed to work seamlessly with ThinkOrSwim.

How can I get support?

If you need any assistance or have any questions, please don't hesitate to contact our support team.

Can I customize the scripts?

Yes, our financial scripts are fully customizable, allowing you to tailor them to your specific trading strategies and preferences.

Is there a refund policy?

Yes, we offer a 30-day money-back guarantee. If you're not satisfied with our financial scripts, we'll refund your purchase, no questions asked.